The Koch family name is synonymous with vast wealth and significant influence in both American business and politics. At the helm of this empire, the late David Koch and his brother Charles have built one of the largest privately held corporations in the United States—Koch Industries. With an annual revenue surpassing $125 billion, Koch Industries stands as a testament to the brothers' business acumen and strategic foresight.

From Humble Beginnings to Industrial Giants

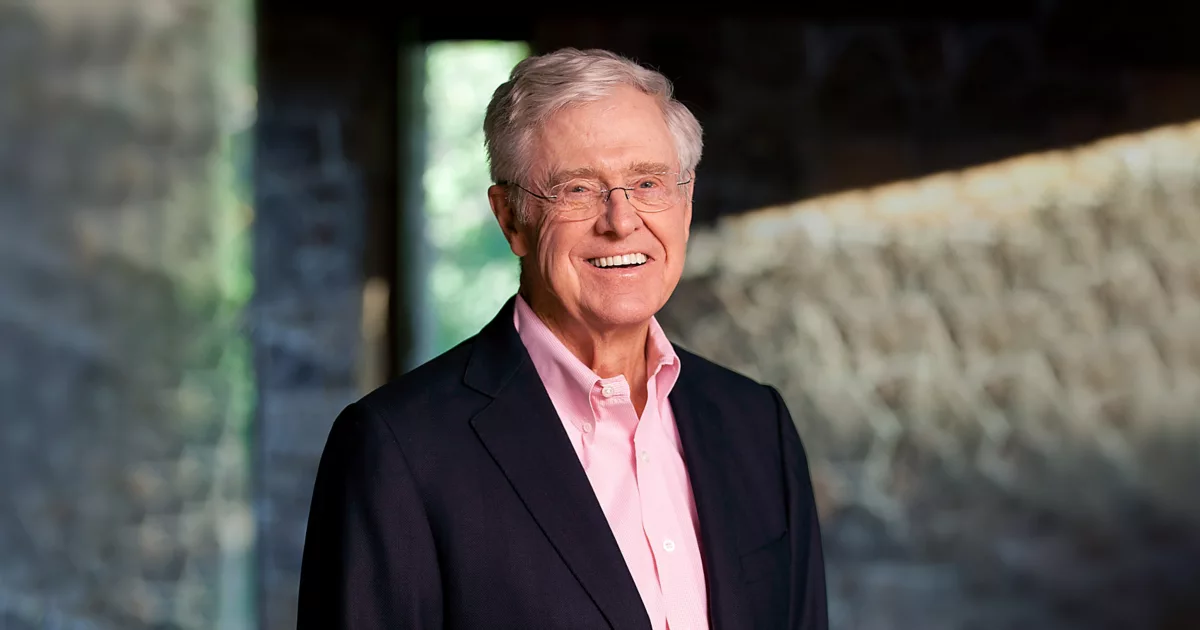

Koch Industries was founded in 1940 by Fred C. Koch, an engineer who developed an innovative method for refining heavy oil into gasoline. After Fred's death, his son Charles took the reins, significantly expanding the company from a regional oil supplier into a global conglomerate. Under Charles and David Koch's leadership, the company's portfolio diversified to include not just energy but also chemicals, agriculture, manufacturing, and finance sectors.

Charles and David, often referred to as the Koch brothers, inherited not only the business but also the ideological leanings of their father, advocating for a libertarian, free-market approach. Their control over Koch Industries solidified after buying out their less-involved brothers, Frederick and William, in 1983 for nearly $800 million, following a contentious family dispute.

Business Strategy: Diversification and Acquisition

Koch Industries' growth strategy has been characterized by aggressive acquisitions and diversification. Here's how they did it:

Diversification: The brothers expanded into various sectors, reducing reliance on any single revenue stream. From paper products (Georgia-Pacific) to chemicals (Invista), electronics (Molex), and software, Koch Industries has a hand in myriad industries. This approach helped them navigate economic downturns by not being tied to one volatile market.

Acquisitions: Some of the most notable acquisitions include Georgia-Pacific in 2005 for $21 billion, making Koch one of the world's leading producers of pulp, paper, and building products. Other significant buys include Infor, Guardian Industries, and Jorf Fertilizers, showcasing their strategy of buying companies with strong cash flows or those that complement their existing businesses.

Long-term Investment: Unlike many publicly traded companies focused on quarterly earnings, Koch operates with a long-term investment horizon. Charles Koch's philosophy of reinvesting 90% of profits back into the company has allowed for sustained growth and innovation. This approach has been particularly successful in expanding their reach in the fertilizer and energy sectors.

Controversies and Criticisms

The Koch brothers' business practices have not been without controversy:

Environmental and Regulatory Issues: Koch Industries has faced numerous legal challenges over environmental pollution, with significant fines for violations. Their operations in oil, chemicals, and fertilizers have led to scrutiny from environmental groups and regulatory bodies.

Political Influence: Perhaps more famously, the Koch brothers are known for their political activities, funding libertarian and conservative causes through a network of think tanks and advocacy groups. Their contributions to American politics have been substantial, influencing policy on climate change, taxes, and regulation. Critics accuse them of using their wealth to sway public policy in favor of deregulation and free-market principles.

Union and Worker Relations: Koch Industries has been at odds with labor unions, often seen as anti-union, which has led to tensions in workplaces where they have acquired companies with organized labor.

The Future of Koch Industries

After David Koch's death in 2019, Charles Koch, now in his late 80s, continues to steer the company, with his son Chase Koch taking on significant roles, particularly in venture capital and philanthropy. The company remains privately held, which allows for strategic decisions without the pressure of public shareholders. However, there's speculation about the future direction of Koch Industries, especially after Charles's eventual retirement.

The Kochs' business model, centered around market-driven principles, operational efficiency, and long-term investment, has made them a powerhouse in American industry. Nevertheless, their legacy is a complex tapestry of ingenious business strategies, political influence, and continuous debate over their impact on society, environment, and governance.

As we look towards 2025, Koch Industries remains a formidable force, continuing to shape not just the markets it operates in but also the broader political and economic landscape of the United States.